does td ameritrade report to irs

TD Ameritrade hosts an OFX server from which your 1099-B realized gain and loss information may be retrieved by our program. Under the Documents listing locate your T5.

Covered Non Covered Basis Options Trading Tax Info Ticker Tape

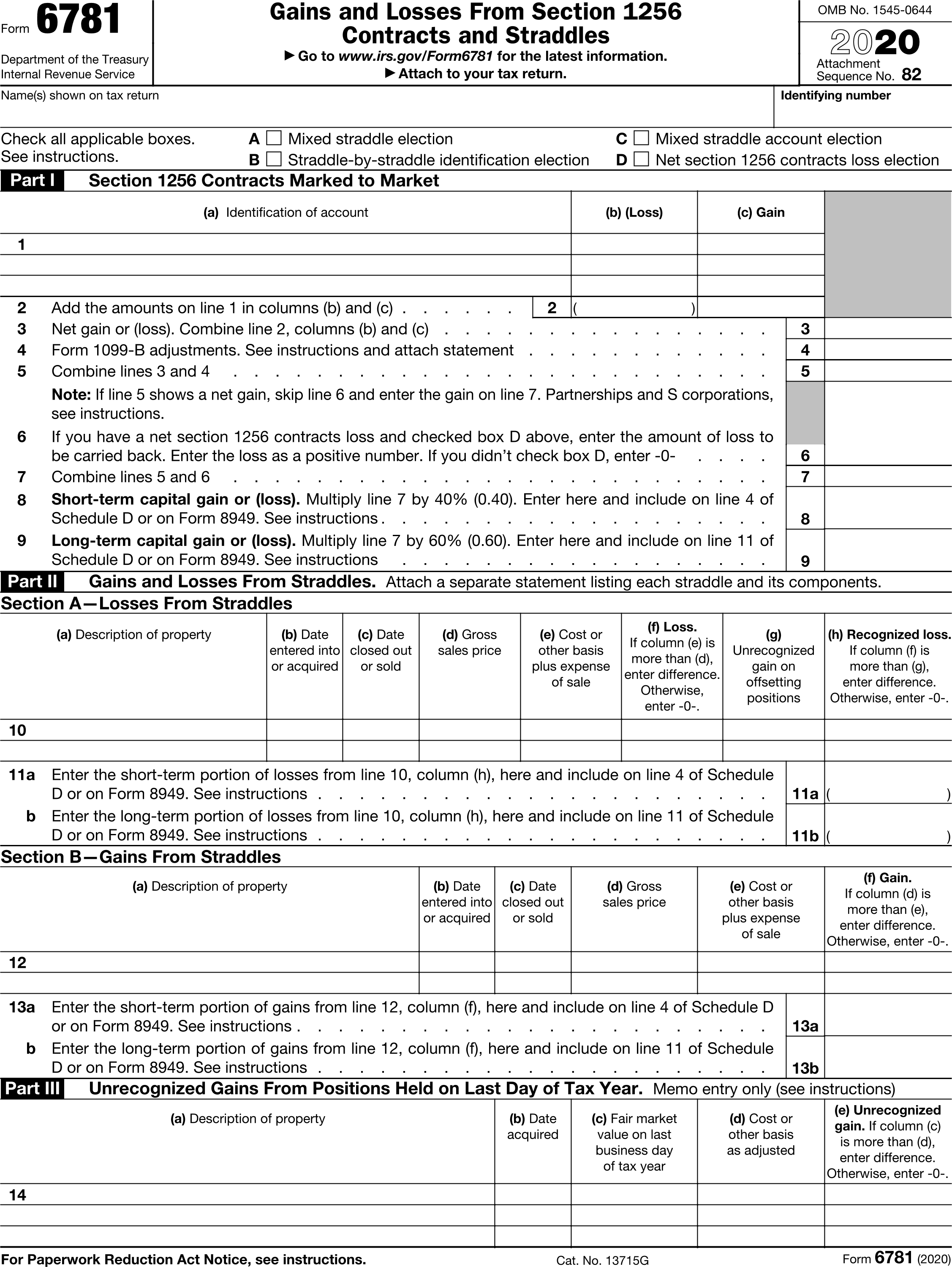

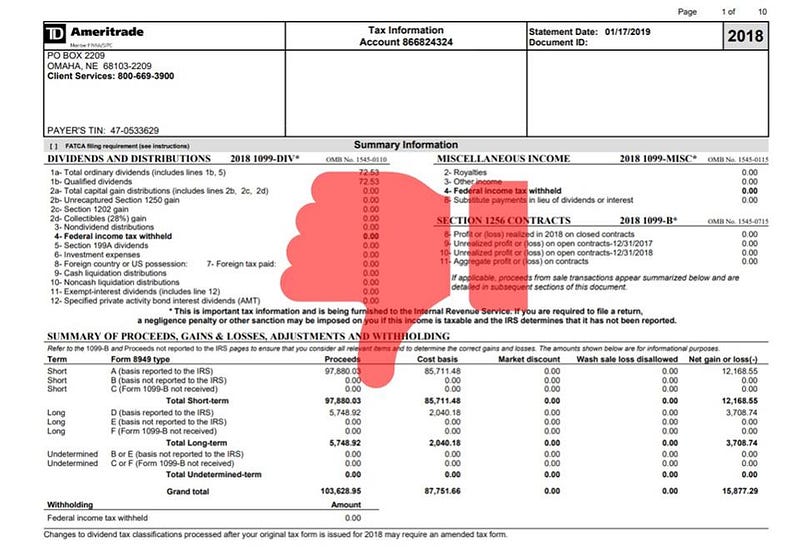

Form 1099-B Proceeds from Broker and Barter Exchange Transactions is used to report the sale of stocks bonds mutual funds and other securities to the IRS.

. The topic of this. The custodian bank is charged with safeguarding your financial assets to report required information to the IRS eg 1099s etc and provide you statements of your holdings. Have you talked to a tax professional about this.

TD Ameritrade does not report this income to the IRS. You pay tax on it if you profit income tax rate if short term capital gains. To retrieve information from their server you will.

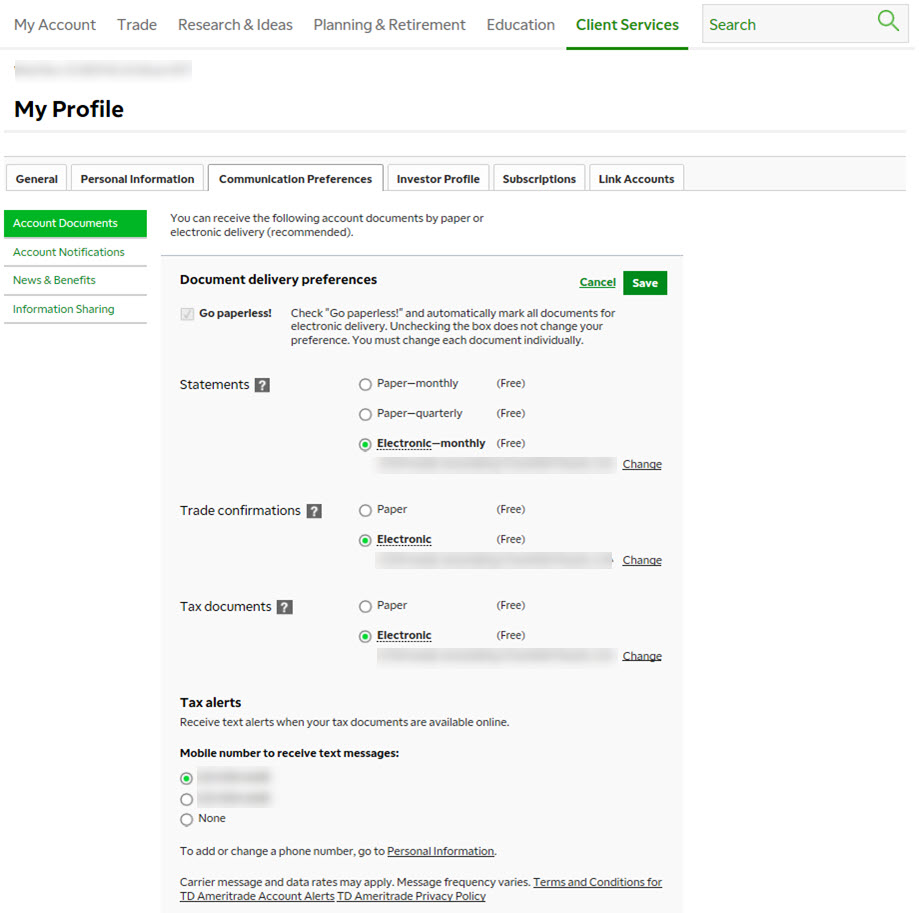

Under the My Accounts list in the left hand column click View e-Documents. Steps to access your T5 through online banking. Intraday data is delayed at least 20 minutes.

Individual Tax Return Form 1040 needs to be filed with the IRS by April 15 in most years. Since January 1 2013 brokers are required to report options trades to the IRS. My TD Ameritrade Tax Statement shows.

Have you talked to a tax professional about this. TD Ameritrade will not report cost basis information on tax-exempt accounts to the IRS. Anything else you want the.

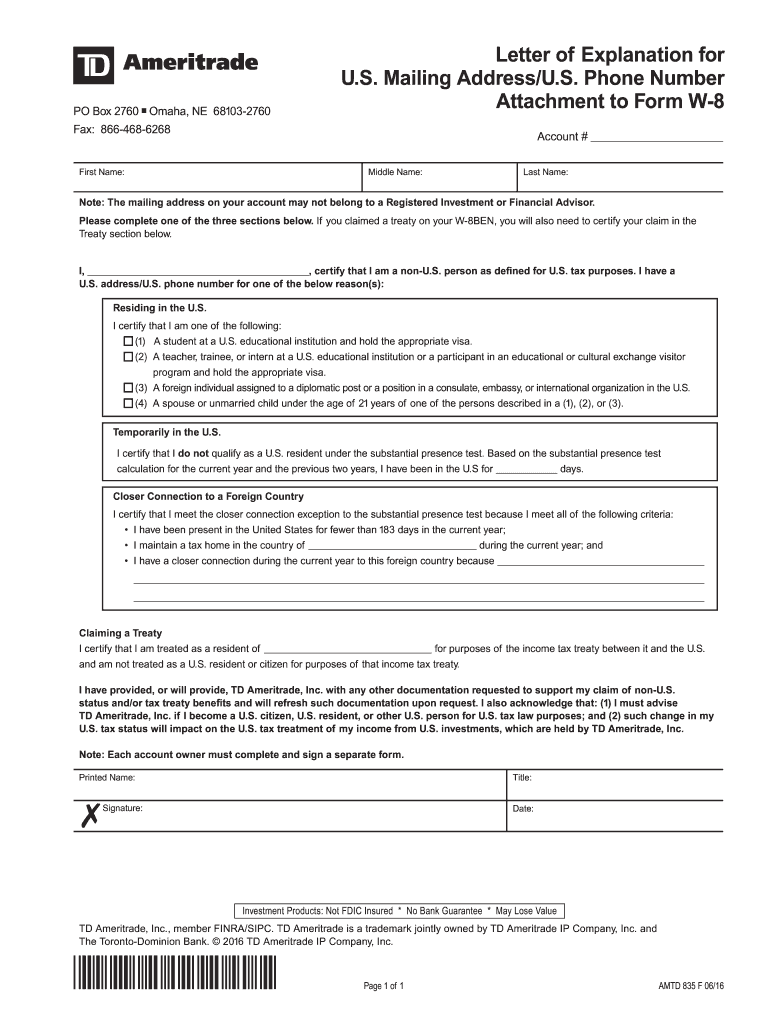

Document ID Number What does TD Ameritrade report to IRS-----The most important part of our job is creating informational content. Like options-trading strategies the tax treatment of options trades is far from simple. Does Ameritrade report to the IRS.

Understanding Form 1040.

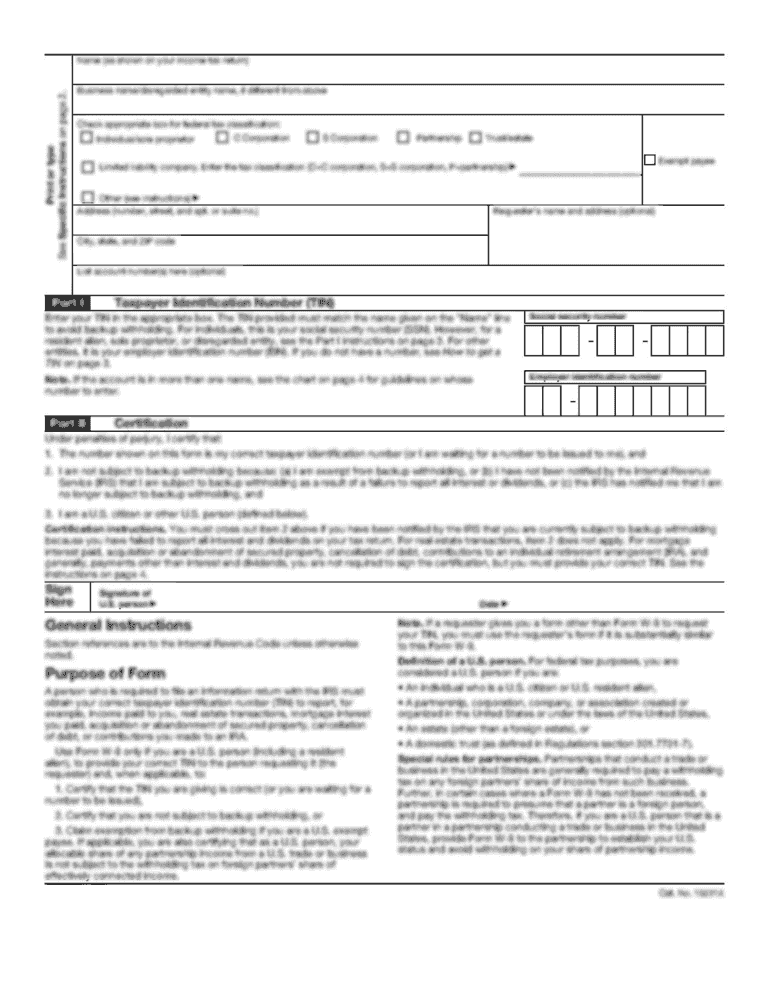

Td Ameritrade Foreign Application Filling Up Irs W 8ben And Trusted Contacts Part 3 Youtube

Td Ameritrade W9 Form Fill Out Sign Online Dochub

W8ben Td Ameritrade Fill Online Printable Fillable Blank Pdffiller

What Is Fatca And What Does It Mean For Investors

Follow Up Post Last Week I Made A Post About What Td Ameritrade Sent Me In Regards To My Shares Being Non Covered Today I Took Action And Filed Complaints With The Sec

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

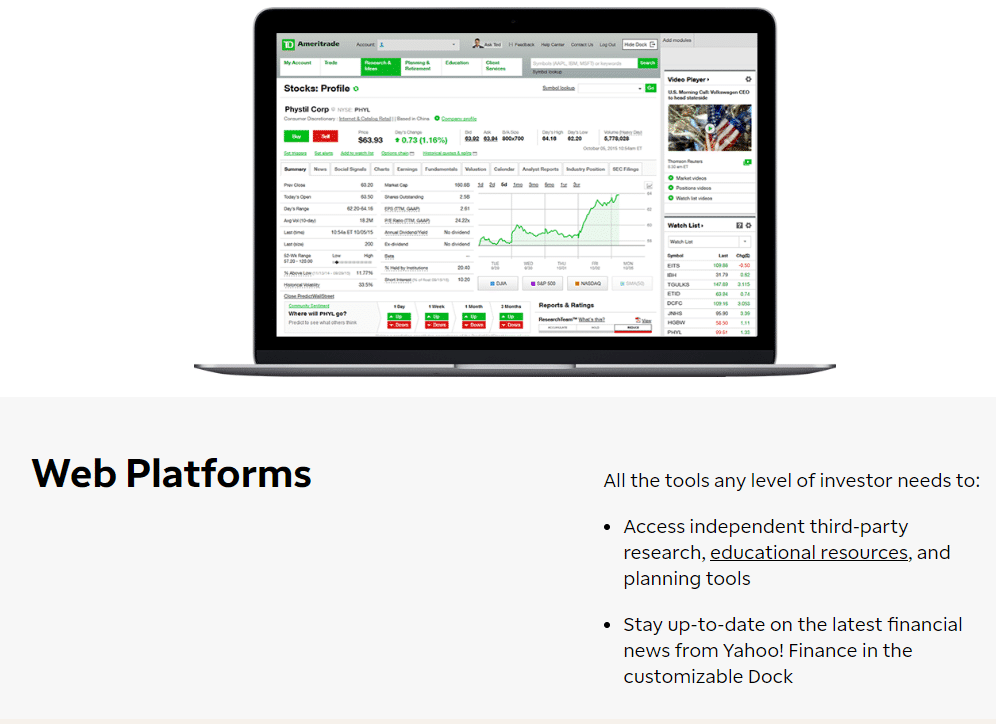

Td Ameritrade Review A Leading Online Stock Broker

Td Ameritrade Internal Transfer Form Fill Online Printable Fillable Blank Pdffiller

Taxes How To Report Crypto Transactions To The Irs Youtube

Td Ameritrade Review A Robust Investing Platform

Get Real Time Tax Document Alerts Ticker Tape

Follow Up Post Last Week I Made A Post About What Td Ameritrade Sent Me In Regards To My Shares Being Non Covered Today I Took Action And Filed Complaints With The Sec

What Is Schedule D How To Report Capital Gains And Losses

How To Read Your Brokerage 1099 Tax Form Youtube

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

Td Ameritrade Review A Leading Online Stock Broker

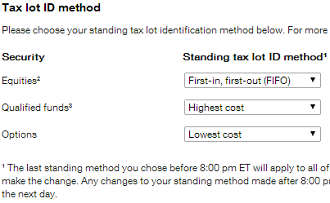

Choose The Right Default Cost Basis Method Novel Investor

Charles Schwab To Buy Td Ameritrade For 26 Billion Reports Say Investmentnews